It is called fraud and I would not blame, directly blame, the City of Detroit, Wayne County, the State of Michigan, neither do I fault the U.S. Government because they all got duped by a set of nefarious actors, engaging in personal inurement of public office, with the support of those wonderful NGOs and whatever the hell a Quasi-governmental organization is, to execute complex fraud schemes, where there is a home, in each stratefied sector of public service, sophisticated machinations of privatization.

It is fraud.

They stole the children, the land and the votes, yet, "The Elected Ones" have no qualms ignoring this fact as they stuff their pockets full of NGO money while taking fashion show selfies for their political campaign Facebook page.

They even stole the property taxes.

I have previously published how the City of Detroit contracts with Wayne County to collect delinquent property taxes, but as soon as the batch of collection for the delinquent property tax amounts gets sent over to Wayne County Property Tax Division, the property tax record with the City of Detroit mysteriously becomes omitted from the city record, but never notifies Wayne County Treasurer.

During this window, the properties are then processed through a quiet title action, which wipes the taxes.

The properties then, never go to public auction, and are processed, without any chain of command, to the Detroit Land Bank Authority.

Oh, and I forgot to mention the property tax assessments are arbitrary and capricious as the city does not have any licensed or certified property tax assessors.

In short, the property taxes for this segment of properties is just fraud to ensure the homeowner will lose a property in high demand of private investors.

Below, The State of Michigan signed into law, special property tax legislation, that would place a 50% special tax reversion to an "authority" specified in the Michigan Land Bank Fast Track Authority, to use the money to pay back loans made by the authority.

Well, if you do not know, the Detroit Land Bank Authority, which has no affiliation nor association with the Michigan Land Bank Fast Track Authority, as stated in multiple documents, local news reports, and many other media, journalistic recordkeeping, including the Michgian Land Bank Fast Track Authority, itself, just so happens to get to capture 50% of special assessment property taxes.

Did you also know that the Detroit Land Bank Authority also levies its own taxes, that do not exist?

Now, how is it a quasi-governmental-entity, which has violated its own Articles of Creation, sealed by the State of Michigan, by failing to incorporate, able to open a bank account to cash the checks the State of Michigan deposits into a financial institution of the Detroit Land Bank Authority?

Well, if you did not know, the Detroit Land Bank Authority has no bank accounts because it never incorporated, which takes us to the next logical line of questioning - How did the Detroit Land Bank Authority get to take out loans?

Yes, that is correct. The Detroit Land Bank Authority took out loans, federal loans, from the Neighborhood Stabilization Program 2, then got the boon of the 50% special property tax kickback to payback the loan, but instead of paying back the loans, they did another quiet title on the properties to wipe the loans from the books.

So, in essence, you cannot blame the "government", you are going to have to blame specific actors in public office and others in the public light of an authority for allowing this to happen, then allowing nothing to be done about the fraud.

They stole the children's legacies, and no one cares, not even "The Elected Ones".

Stay tuned.

VICE News - HBO Video On Detroit Tax Foreclosure Auctions Kicking People Out Of Their Homes

They even stole the property taxes.

I have previously published how the City of Detroit contracts with Wayne County to collect delinquent property taxes, but as soon as the batch of collection for the delinquent property tax amounts gets sent over to Wayne County Property Tax Division, the property tax record with the City of Detroit mysteriously becomes omitted from the city record, but never notifies Wayne County Treasurer.

During this window, the properties are then processed through a quiet title action, which wipes the taxes.

The properties then, never go to public auction, and are processed, without any chain of command, to the Detroit Land Bank Authority.

Oh, and I forgot to mention the property tax assessments are arbitrary and capricious as the city does not have any licensed or certified property tax assessors.

In short, the property taxes for this segment of properties is just fraud to ensure the homeowner will lose a property in high demand of private investors.

Below, The State of Michigan signed into law, special property tax legislation, that would place a 50% special tax reversion to an "authority" specified in the Michigan Land Bank Fast Track Authority, to use the money to pay back loans made by the authority.

Well, if you do not know, the Detroit Land Bank Authority, which has no affiliation nor association with the Michigan Land Bank Fast Track Authority, as stated in multiple documents, local news reports, and many other media, journalistic recordkeeping, including the Michgian Land Bank Fast Track Authority, itself, just so happens to get to capture 50% of special assessment property taxes.

Did you also know that the Detroit Land Bank Authority also levies its own taxes, that do not exist?

Now, how is it a quasi-governmental-entity, which has violated its own Articles of Creation, sealed by the State of Michigan, by failing to incorporate, able to open a bank account to cash the checks the State of Michigan deposits into a financial institution of the Detroit Land Bank Authority?

Well, if you did not know, the Detroit Land Bank Authority has no bank accounts because it never incorporated, which takes us to the next logical line of questioning - How did the Detroit Land Bank Authority get to take out loans?

Yes, that is correct. The Detroit Land Bank Authority took out loans, federal loans, from the Neighborhood Stabilization Program 2, then got the boon of the 50% special property tax kickback to payback the loan, but instead of paying back the loans, they did another quiet title on the properties to wipe the loans from the books.

So, in essence, you cannot blame the "government", you are going to have to blame specific actors in public office and others in the public light of an authority for allowing this to happen, then allowing nothing to be done about the fraud.

They stole the children's legacies, and no one cares, not even "The Elected Ones".

Stay tuned.

VICE News - HBO Video On Detroit Tax Foreclosure Auctions Kicking People Out Of Their Homes

DETROIT’S HOUSING CRISIS IS THE WORK OF ITS OWN GOVERNMENT

The city overtaxed homeowners for years. Those who couldn’t pay are still feeling the pain.

Detroit’s housing crisis is the work of its own government

DETROIT — Jennine Spencer had always wanted to own the house next door. When she was a little girl, the owner kept the beautiful Victorian immaculate. So when it went into mortgage foreclosure in 2010 and two years later came up for sale for just $1,500, she dipped into her modest savings and paid cash.

The house had sat vacant as the recession rolled through Detroit, and scrappers had stripped it down to the doorknobs. It had no furnace, no water heater — even the sinks and toilets were gone. Spencer had to spend $10,000 just to make it habitable. And the house came with another problem, bigger than missing appliances: The previous owner had left $16,000 in unpaid city property taxes, a debt that Spencer now owed.

The debt quickly proved too much for her. She was making about $20,000 a year running a hair salon she owned nearby and was putting her two daughters through college. Her parents were getting older, and she had to care for them, too. She fell behind on tax payments only months after she’d bought the house, and soon went into tax foreclosure. She arrived home one day in October 2012 to find a speculator sniffing around the property. The house had been put up for auction.

In 2012, Jennine Spencer bought the house next door to where she grew up, then lost it to tax foreclosure. She bought it back again, but had to fight to keep current on inflated tax bills.

After the financial crisis, mortgage foreclosures claimed 65,000 of Detroit’s homes. But the city has faced an even bigger problem with tax foreclosures, which have claimed nearly 73,000 more homes and created a second-wave housing crisis that has no parallel in other American cities. Tens of thousands of Detroit’s foreclosed buildings have succumbed to blight. And a majority of the 673,000 people in the city, once a bastion of black working-class homeownership, now rent instead of own.

In many ways, government policy has contributed to this crisis. Detroit levies the highest property tax rate of any large city in the country, around 3.8 percent (the national average is just 1.5 percent).

When tax bills go unpaid, the city turns them over to Wayne County for collection. The county can charge homeowners up to 18 percent interest plus penalty fees, and they have just two and a half years to pay off the debt before the county confiscates and sells their property in a public auction.

When tax bills go unpaid, the city turns them over to Wayne County for collection. The county can charge homeowners up to 18 percent interest plus penalty fees, and they have just two and a half years to pay off the debt before the county confiscates and sells their property in a public auction.

Thousands of properties, many of them still occupied, end up in the tax foreclosure auction each year.

Spencer’s house sold for a $3,600 bid in 2012. But she was determined to stay in the house and to figure out a way to buy it back from the new owner. Within a few months she succeeded, but she found herself still struggling to pay the taxes on the house. She eventually faced foreclosure twice more, in 2015 and 2016. Each year, she has barely scraped together the money to keep her home out of the auction. All in all, she’s paid the Wayne County treasurer a total of $9,484 to keep her home, a third of that in interest and fees.

Spencer’s house sold for a $3,600 bid in 2012. But she was determined to stay in the house and to figure out a way to buy it back from the new owner. Within a few months she succeeded, but she found herself still struggling to pay the taxes on the house. She eventually faced foreclosure twice more, in 2015 and 2016. Each year, she has barely scraped together the money to keep her home out of the auction. All in all, she’s paid the Wayne County treasurer a total of $9,484 to keep her home, a third of that in interest and fees.

“I’ve had to struggle and fight so hard to stay in my home,” she said, sitting in the front room of her house this fall. “Every day it’s a battle.”

But she says she could have afforded to pay the city on time — if her tax bills had been fair.

The year she bought back the house, for $7,665, her tax bill was almost $2,400. The city assessor had set the value of her property at around $56,000. In other words, the city said her home was worth roughly seven times what she paid for it, and her resulting tax bill was seven times what it should have been.

Indeed, Spencer’s taxes, and those of tens of thousands of other Detroit homeowners, were not just high. For years, they were illegal. Each year a startling number of homeowners have fallen behind on those inflated taxes, receiving bills and eventually foreclosure notices from Wayne County.

The county knows taxes were too high, but nevertheless it keeps taking people’s money, and their homes. Many advocates are scratching their heads trying to understand why the government isn’t doing more to correct the injustice. But there’s evidence that it simply can’t afford to.

Property in Detroit was already cheap compared to other large cities, but the recession pushed home values into free fall. By 2009, the median sale price of residential property had plunged 86 percent, to $9,500. Michigan law says that loss in value should have led to a proportional drop in property assessments, which are used to determine property taxes. But Detroit’s assessors, already understaffed and underresourced, were barely functional as the city’s own finances imploded. They kept assessing homeowners at levels for some imaginary market, even as the government slashed services and Detroit headed toward municipal bankruptcy.

A recent analysis by Chicago-Kent College of Law professor Bernadette Atuahene and Detroit-area urban economist Tim Hodge estimates that at least 55 percent of homes in the city were assessed beyond the legal limit between 2009 and 2015. In the worst year, 2010, as many as 85 percent of homes may have been overassessed.

The result was an unnecessary financial strain on both longtime and new homeowners in a period when many could least afford it. By 2010, the city had lost more than 200,000 jobs, and thousands of residents had fallen into poverty. Many of the city’s homeowners were now struggling to make ends meet. Tax bills fell behind more urgent concerns like dealing with home repairs and keeping utilities on.

Mayor Mike Duggan, who took office in 2014 and was re-elected last month, has conceded that inflated taxes led to a higher rate of tax delinquency and that some foreclosures could have been avoided if taxes had been fair. In 2014, the city began a three-year effort to correct tax bills going forward by reassessing every parcel individually, something Detroit hadn’t done in decades. As a result, more than half of this year’s tax bills have been reduced. Some have been cut by more than 50 percent.

In a 2015 press conference on the reassessment effort, Duggan said Detroit’s property tax collection rate was improving as a result. “When we assessed people honestly, a lot more people started paying their taxes,” the mayor told reporters, “which is going to mean a significant reduction in foreclosures.”

Even so, an independent report to the State Tax Commission noted that Detroit’s 2017 residential assessments were well outside industry standards for accuracy and said the city still had a lot of work to do to bring its assessments into line. (Duggan declined an interview request, and a city spokesperson said in an email that the city’s assessments are now set through “fair and thorough processes.”)

Figuring out just who was overtaxed, and by how much, would require retroactively calculating assessments as of past market conditions, something the mayor hasn’t signaled he would consider. And while assessments are generally much more fair than they used to be, tens of thousands of homeowners have already paid well beyond what they should have owed, and many lost their homes because they couldn’t keep up. This year’s 6,000 foreclosures, for example, are the result of owners failing to pay taxes levied in 2014, when an estimated 83 percent of Detroit’s homes were illegally assessed.

Michele Oberholtzer, who heads up the tax-foreclosure counseling unit at a Detroit nonprofit called the United Community Housing Coalition, likens the foreclosure of overtaxed homes to the use of false evidence to convict a suspected criminal. “It was known that this wasn’t done properly,” she said. “It’s a form of theft. It’s taking private property from people without compensation on the basis of something false.”

Wayne County’s treasurer, Eric Sabree, has acknowledged that his office is still collecting taxes that were unfairly assessed. But he says he has no jurisdiction over assessments (which are done by the city) and argues that state law does not allow him to alter the foreclosure process, even when the foreclosures are based on inflated tax bills.

Housing advocates point out that the treasurer’s office has for years exercised wide discretion over which properties are seized and which are not. They also say that local officials should lobby the state, as they have in the past, to allow the county to provide more relief. A pending lawsuit from the Michigan ACLU demands that the county halt foreclosures “until proper and lawful taxes are assessed.”

So far, though, the treasurer has said the county is doing nothing wrong and won’t consider taking these actions.

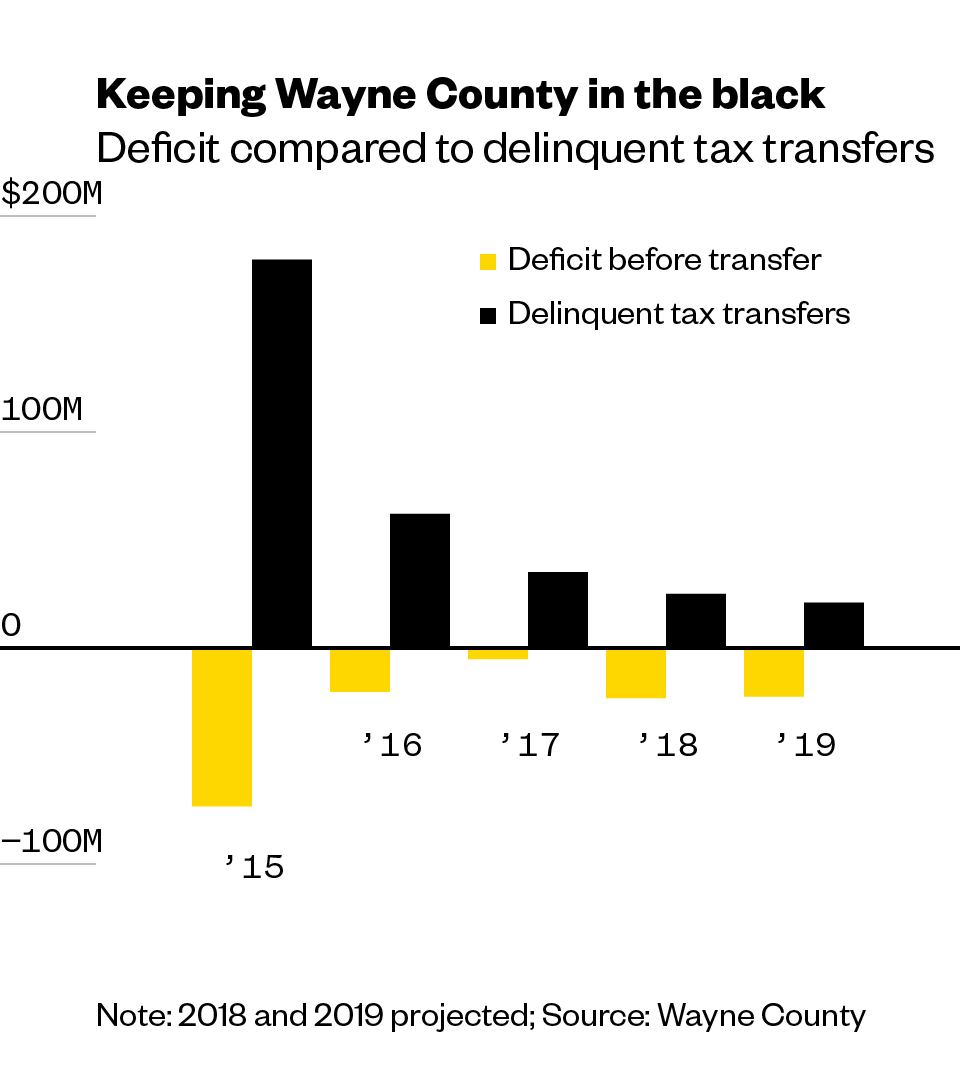

But Wayne County has one big incentive to keep collecting all the delinquent property taxes it can: According to fiscal data provided by the county executive’s office, it depends on delinquent tax revenue to balance its budget.

Tax-foreclosed homes often sit vacant, which makes them susceptible to blight. (Mark Betancourt for VICE News)

Wayne County is in charge of foreclosures in Detroit because it owns the city’s uncollected tax debt. Every year, some proportion of Detroit’s property owners fail to pay their property tax bills on time. Michigan law allows the city to sell those uncollected taxes to the county treasurer to make up the shortfall. The county treasurer then tries to collect the back taxes from property owners and sells their properties at auction if they fail to pay.

Through this process, the county is able to make a surplus — essentially a profit — from the interest and penalties collected from delinquent property owners and from some auction sales. The county can then transfer that surplus money to its general fund for use elsewhere in its budget.

This is no small amount of money. According to Wayne County financial documents, since the current foreclosure process was implemented, in 2002, the county has transferred more than half a billion dollars in surplus delinquent tax collections to its general fund. Most of that was made from properties in Detroit. And that money has been not just helpful to Wayne County, but vital.

“We have a nostril above water,” said Wayne County Commissioner Tim Killeen, whose District 1 includes the far eastern edge of Detroit. Out of a $1.45 billion budget, the county is only $30 million from running a deficit. “If a canoe goes by,” Killeen said, “the wake will put us under.”

Like the City of Detroit, the county has struggled to stay afloat since the recession. But the wave of tax delinquency that came with the downturn — made worse by the city’s inflated assessments — became a lifeline for the county budget.

If delinquent tax transfers over the past three years hadn’t exceeded expectations, data provided in early November by the county executive’s office shows, the county would be running a $21 million deficit right now.

County officials vowed in 2015 to stop relying on surplus delinquent tax revenue to balance their budget. But documents show that the county’s bottom line has changed little since then, and that it still plans to lean on surplus transfers through at least the next two years. In fact, if delinquent tax earnings don’t continue to surpass expectations, the county may be facing a small deficit in 2019.

That would seem to give the county little short-term incentive to halt foreclosures or forgive debt owed on Detroit’s inflated taxes. The county declined repeated requests to make officials who oversee financial matters, including Sabree, available for comment.

While the county commission doesn’t control the treasurer’s office or how it handles tax delinquency, Killeen is looking for ways to help end the squeeze on low-income homeowners. But he also offered a realistic assessment of the situation: Resolving the tax foreclosure crisis would mean closing the fiscal gap some other way. “I do not like the idea of making money off people’s misery,” Killeen said.

“However, what is the alternative?”

“However, what is the alternative?”

There has been some progress in addressing Detroit’s tax foreclosure problem. The number of foreclosed owner-occupied properties has gone down by 88 percent in the last two years to 786 in 2017, a fact both the city and county governments tout as evidence of their resolve to end the crisis.

The city has long offered an exemption on property taxes for homeowners living below the poverty line, and recently it has tried harder to publicize this program and to streamline the application process. For its part, the county has pushed delinquent taxpayers to get onto payment plans, which allow them to avoid foreclosure as long as they can keep current on city taxes and make monthly payments on back taxes to the county treasurer. And in 2014, Mayor Duggan successfully lobbied for reduced interest on tax payment plans and more time for homeowners to pay off their debts (about one-quarter of those who sign up for plans now get these concessions).

But there’s a catch: The payment plans may be only delaying foreclosures, rather than preventing them. An analysis of tax delinquency data conducted with Loveland Technologies, a Detroit-based property mapping and data company that has extensively studied the tax foreclosure crisis, shows that the collective debt of the city’s single-family homes remains largely unchanged since last year.

So despite the two governments’ efforts, homeowners aren’t necessarily making real progress in reducing what they owe. And according to the data, a similar number of single-family homes — around 39,000 — were more than two years delinquent on taxes this fall compared to a year earlier.

So despite the two governments’ efforts, homeowners aren’t necessarily making real progress in reducing what they owe. And according to the data, a similar number of single-family homes — around 39,000 — were more than two years delinquent on taxes this fall compared to a year earlier.

The Wayne County Treasurer’s office declined to disclose how many homeowners are failing to stay on their payment plans. Oberholtzer, the housing counselor, believes the default rate is high.

“People bought one or two or even three years just by getting on the plan,” she said. “A lot of those people have been or will be kicked off of those payment plans, and they’ll owe more than ever.” She warned that a new wave of foreclosures could be on the way.

Oberholtzer is already beginning to see some of the 23,000 Detroit homeowners who received foreclosure notices this fall trickling into her office, asking for help. They’re delinquent on taxes levied two years before the city’s reassessment was completed, so they still could lose their homes over illegally inflated bills.

This year, for the first time, Jennine Spencer is square with Wayne County and current on her city taxes. That’s partly thanks to the income-based exemption she now receives, which allows her to pay the city just $134 a year for garbage collection. But the exemption did nothing to erase what she owed Wayne County on the earlier inflated tax bills she failed to pay, and clearing those debts required a painful sacrifice.

This past May, Spencer made the choice to close her hair salon business. She’d been siphoning funds from the business to pay down her property tax debt and couldn’t afford to keep both the business and her home.

It was a tough loss. She’d not only made a living from her work there but also offered free haircuts to the homeless and to kids heading back to school. “I did a lot of community service out of that salon,” she said. “Now I can’t offer that service.” She now works part time at a salon in Roseville, a 20-minute drive outside the city.

But, she says, the sacrifice was worthwhile. It’s more important to remain in the community she grew up in, where she’s become an organizer and an advocate, and where she can take care of her mom, who lives next door.

She says she was raised to value these things, and to meet her financial responsibilities, at any cost. “I had to make it happen,” she says. “Because if I didn’t, I would fail. And I was not a failure.”

Mark Betancourt is a freelance journalist based in Washington, D.C.

Research and analysis of tax foreclosure data was provided by Loveland Technologies. Historical sales and assessment data and analysis were provided by ATTOM Data Solutions and Data Driven Detroit.

Voting is beautiful, be beautiful ~ vote.©

1 comment:

Since VICE is fluttering around as foreign #coloredrevolution fairies, promulgating false claims in the public record, let us see if they are willing to bond thine body and soul to the veracity of their words, since everything is already public...

Post a Comment